Dear CoreWeave Stock Fans, Mark Your Calendars for October 30

/AI%20(artificial%20intelligence)/Data%20Center%20by%20Caureem%20via%20Shutterstock%20(2).jpg)

Core Scientific (CORZ) shareholders are heading to the polls on Oct. 30 to vote on CoreWeave's (CRWV) $9 billion acquisition bid. According to CNBC's David Faber, the deal is expected to fail, with large institutional holders and activist investors signaling an intent to reject the offer.

The proposed all-stock transaction would give Core Scientific shareholders 0.1235 CoreWeave shares for each share they own, valuing CORZ at roughly $20.40 per share. While that represents a 66% premium to Core Scientific's price before deal talks leaked, many investors believe the company deserves more. Some shareholders are pushing for a valuation closer to $25 per share, or about $11.5 billion total, according to reports from the Financial Times.

CoreWeave CEO Michael Intrator made his position clear this week, stating the company won't sweeten its bid regardless of shareholder sentiment. He insists the current offer fairly represents Core Scientific's value and would benefit both companies moving forward.

The deal would give CoreWeave ownership of 1.3 gigawatts of data center capacity and eliminate $10 billion in future lease obligations. Core Scientific emerged from bankruptcy in 2024 and has shifted focus from cryptocurrency mining to high-performance computing workloads. The transaction was set to close in the fourth quarter of 2025, pending approvals.

CoreWeave went public in March and has seen its stock quadruple since listing. Despite recent gains, both stocks have been volatile since the acquisition was announced. If shareholders vote no next week, CoreWeave will need to decide whether to walk away or reconsider its stance on negotiations.

Is CoreWeave Stock a Good Buy Right Now?

CoreWeave is executing at a level that's difficult to overstate. The company just reported Q2 revenue of $1.2 billion, growing 207% year-over-year (YoY). Moreover, contracted backlog doubled year-to-date (YTD) to reach $30.1 billion.

CEO Michael Intrator and CFO Nitin Agrawal have been making the rounds at major conferences, and their message is consistent: demand remains relentless. CoreWeave is chronically supply-constrained, meaning customers want more capacity than it can currently deliver.

The AI infrastructure giant ended Q2 with 470 megawatts of active power and expects to end 2025 with 900 megawatts. The scale of customer conversations has exploded, as 18 months ago, deals involved 10-megawatt deployments, while today, customers are discussing gigawatt-plus-scale projects.

CoreWeave's competitive advantage is evident. Independent research firm SemiAnalysis rated them as the only platinum-tier GPU cloud provider, a distinction that includes comparisons against the massive hyperscalers.

Major customers keep expanding their relationships. In the past few months, both of CoreWeave's hyperscaler customers, in addition to OpenAI, signed expansion contracts. What many investors still don't fully appreciate is CoreWeave's financing sophistication.

Since 2024, they've raised over $25 billion in commitments. Moreover, it has slashed non-investment-grade borrowing costs by 900 basis points. The company’s most recent delayed draw term loan came in at SOFR plus 400, fully underwritten by top-tier banks.

CoreWeave is also seeing strong early traction in inference workloads. Inference represents the monetization of AI, and new use cases are proliferating across industries from visual effects to healthcare to financial services.

The company faces a classic challenge: the market needs time to understand its core business model. Intrator acknowledged this directly, noting it took nine months to educate Blackstone and a year to bring Fidelity along.

What Is the CRWV Stock Price Target?

The AI infrastructure build-out is planetary in scale, with CoreWeave positioned at its center, leveraging differentiated technology, strong customer relationships, and increasingly attractive capital access.

Analysts tracking CoreWeave stock forecast revenue to increase from $5.26 billion in 2025 to $25.8 billion in 2029. It is forecast to report an adjusted earnings of $5 per share in 2029, compared to a loss per share of $1.54 in 2025. If CRWV stock is priced at 50x forward earnings, which is reasonable for a high-growth stock, it could gain around 75% over the next three years.

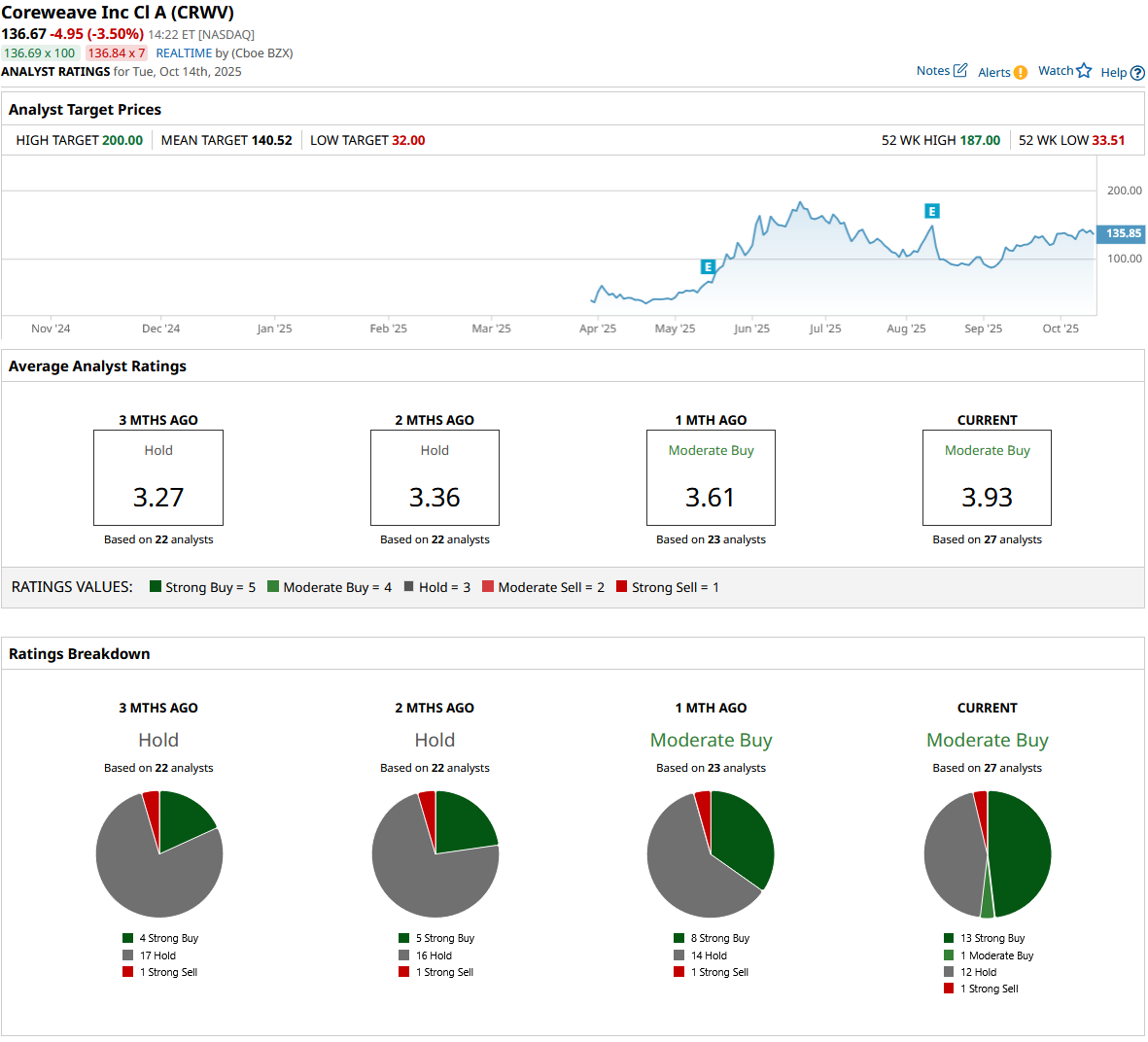

Out of the 27 analysts covering CoreWeave, 13 recommend “Strong Buy,” one recommends “Moderate Buy,” 12 recommend “Hold,” and one recommends “Strong Sell.” The average CRWV stock price target is $140.52, which is similar to the current trading price.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.