Up 591% in a Year, Can Rocket Lab Stock Sustain Its Momentum?

/The%20front%20of%20a%20Rocket%20Lab%20corporate%20office%20by%20Emagnetic%20via%20Shutterstock.jpg)

Rocket Lab (RKLB) has emerged as one of the top-performing stocks, rising over 590% in a year. The surge reflects significant structural tailwinds reshaping the space industry. Governments across the world are sharply increasing defense and space budgets in response to geopolitical tensions. In addition, private capital continues to pour into space ventures, and satellite technology is expanding into new commercial domains, from logistics to agriculture, providing additional tailwinds.

At the same time, the cost of launching satellites has steadily declined, and advances in reusable rocket technology have further lowered barriers for both commercial and government customers.

Rocket Lab, with its diversified suite of offerings, including launch services, satellite manufacturing, spacecraft components, and on-orbit management, is well-placed to capitalize on these trends. Further, the demand for Earth observation, in particular, is surging due to commercial applications and national security requirements, giving Rocket Lab a strong runway for growth.

However, the meteoric rise in Rocket Lab’s stock raises concerns about valuation. The rally in its share price indicates that the market has already priced in a lot of positives. Thus, the future trajectory of RKLB stock hinges on its ability to deliver strong, sustained growth. Let’s take a closer look.

Rocket Lab: Poised for Liftoff in the Expanding Space Economy

Rocket Lab’s trajectory looks promising as the company positions itself at the forefront of a rapidly expanding global space industry. The demand for satellite launches and defense-related missions is growing, and Rocket Lab is well-placed to capitalize on these opportunities. Its Electron rocket, a small orbital launch vehicle, has witnessed demand from a diverse set of international clients, with multiple government space agencies scheduling missions for 2025 and beyond.

Further, Rocket Lab’s progress with its next-generation reusable rocket, Neutron, could give it a significant boost. Designed for larger payloads and reusable missions, Neutron allows Rocket Lab to compete more directly with industry leaders like SpaceX, expanding its addressable market. The shift toward reusability reduces costs and strengthens its sustainable and high-frequency launch capabilities.

Rocket Lab’s recent acquisition of Geost, a manufacturer of missile-tracking satellites, further strengthens its position in national security and defense applications. This move brings with it manufacturing assets in Arizona and Northern Virginia, as well as an advanced inventory of space-based missile warning sensors. The acquisition secures Rocket Lab’s foothold in the U.S. defense supply chain at a time when domestic production of critical space technology is becoming a national priority.

One of the most compelling opportunities ahead is the Golden Dome missile defense program. Rocket Lab’s expanding capabilities, spanning satellite manufacturing, launch services, and sensor technology, position it to benefit from this initiative. Whether as a prime contractor, a subsystem supplier, or a launch provider, Rocket Lab’s vertically integrated model gives it multiple paths to capture value.

Meanwhile, the company’s new reusable Neutron rocket is designed to meet national security launch needs and can deploy entire groups of satellites at once to support large-scale space networks. It has secured over $500 million in contracts with the Space Development Agency (SDA) to build and operate key parts of their PSA network. Further, this allows Rocket Lab to expand using its existing capabilities.

On the commercial front, Rocket Lab’s Space Systems division continues to perform strongly, driven by rising demand for its satellite components and subsystems.

Rocket Lab closed the second quarter of 2025 with approximately $1 billion in total backlog. Moreover, it is focusing on a robust pipeline of multi-launch agreements and large satellite manufacturing deals. This backlog, coupled with a steady flow of new defense and commercial opportunities, provides a solid growth platform.

In essence, Rocket Lab’s diversified revenue streams, expanding capabilities, and strategic alignment with both government and commercial demand position it well to deliver solid growth.

Will Rocket Lab Stock Sustain Momentum?

Rocket Lab’s 591% surge over the past year reflects both the excitement surrounding the space economy and the company’s strong strategic positioning. Its vertical integration across launch services, satellite manufacturing, and defense applications gives it multiple levers for growth. With the Neutron rocket nearing operational readiness, a $1 billion backlog, and deepening ties to U.S. defense programs, Rocket Lab is positioned to benefit from structural tailwinds in both commercial and national security markets.

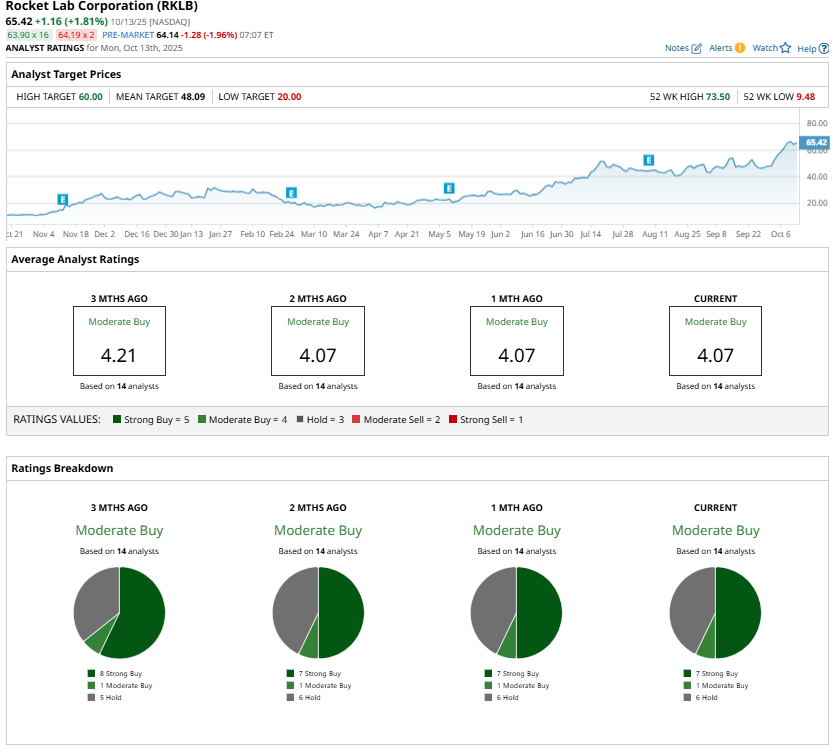

Wall Street is cautiously optimistic and maintains a “Moderate Buy” consensus rating on RKLB stock. While valuation concerns are valid after such a meteoric run, Rocket Lab’s fundamentals and expanding addressable market suggest the rally could have more room to run.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.