Shorting Microsoft Out-of-the-Money Put Options Works Well for Defensive Investors

/Microsoft%20logo%20on%20building%20by%20trazika%20via%20Pixabay.jpg)

Selling short out-of-the-money (OTM) put options in Microsoft Corp. (MSFT) is a proven strategy to gain income and potentially set a lower buy-in point for new investors. This play works well on off days like today.

MSFT is at $513.55 in midday trading on Tuesday, Oct. 14, down slightly in a down market. It's off a recent peak of $535.64 on Aug. 4 and more recently $528.58 on Oct. 6.

As a result, this provides an attractive buying opportunity for new investors in MSFT and potentially an average dollar-cost play for existing shareholders.

One way to do this is to enter an order to “Sell to Open” put options that have lower strike prices than today's price.

Shorting OTM Puts Works

I discussed this in a recent Barchart article (Sept. 9): “Microsoft Stock Is Off Its Highs, But Target Prices for MSFT Are Higher.” I showed that MSFT stock could be worth $671 per share based on its strong free cash flow (FCF).

As a result, I suggested that investors could sell short the $480 strike price put option, which was to expire one month later on Oct. 10.

At the time, MSFT was trading for $499.17, so this $480 strike price was 3.84% below the trading price, or 3.84% out-of-the-money. The premium received was $4.28, or slightly less than 1% yield (i.e., $4.28/$480.00 = 0.00891, or 0.891%).

On October 10, the day the option expired, MSFT closed at $510.96. So, the put option contract expired worthless, and the investors kept the money (as they would otherwise) without having to buy MSFT shares at $480.00.

New Cash-Secured Short-Put Play

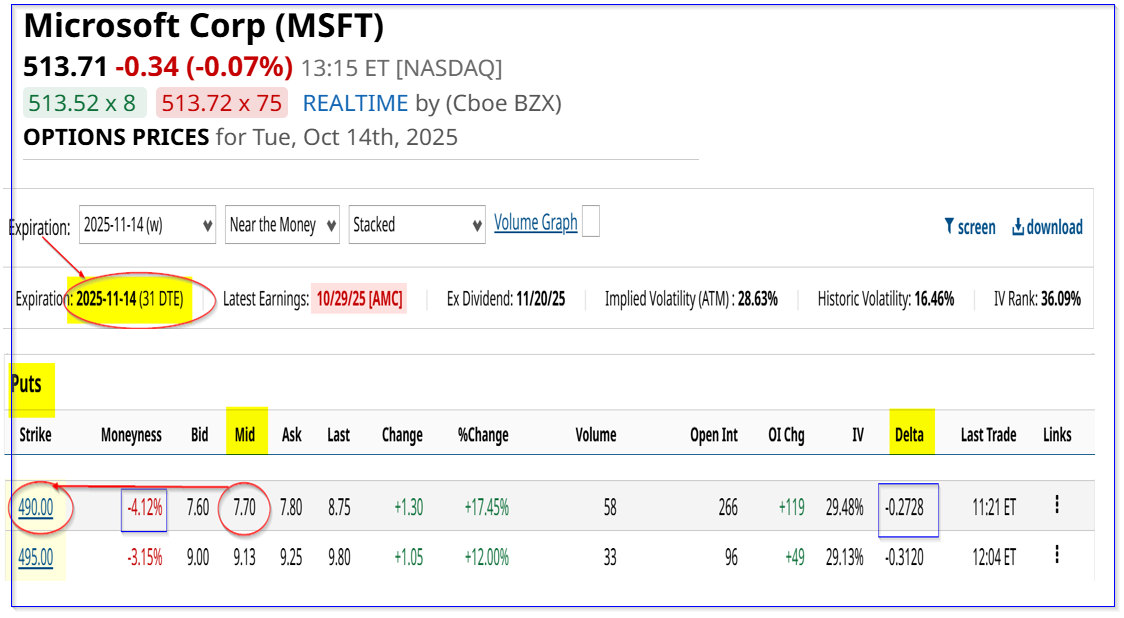

This play can now be repeated. For example, the Nov. 14, 2025, expiry put option expiry period shows that the $490 strike price put has a midpoint premium of $7.70. That provides an investor with an immediate yield of 1.57%:

$7.70 / $490.00 = 0.015714 = 1.5714%

This means that an investor who secures $49,000 in cash or buying power with their brokerage firm can do this trade. They enter an order to “Sell to Open” 1 put contract at $490 expiring Nov. 14. Then their account will immediately receive $770.00

That is why the investment yields 1.57% (i.e., $770/$49,000).

The worst that can happen here is that the cash that was secured as collateral will be used to buy 100 shares of MSFT at $490.00. That would only happen if MSFT falls to $490.00 over the next month.

But even if that occurs, the investor's breakeven point is over 6% lower:

$490.00 - $7.70 = $482.30 breakeven point

$482.30 / $513.71 price today = -6.11% lower

That provides a good entry point for new investors and a way to potentially lower the average cost for existing shareholders.

Downside Risks

Note that there is a relatively low chance of this occurring, as the delta ratio is -.27. That implies a roughly 27% chance that MSFT will fall to $490.00 over the next month, based on past trading volatility patterns.

If that occurs, and if MSFT stock falls below the breakeven point, the investor can end up with an unrealized loss. What would happen then?

First, the investor could repeat the trade for the next month. That could produce more income that would mitigate the unrealized loss of holding MSFT shares below the paid cost (i.e., at the strike price less the income received).

In addition, an investor can sell out-of-the-money (OTM) calls, now that there are 100 shares of MSFT in the account. That also would mitigate any unrealized losses.

Another strategy to play this is to buy in-the-money calls that are further out and then sell out-of-the-money puts. That reduces the all-in outlay cost of doing this play and provides some downside protection.

The bottom line here is that shorting out-of-the-money puts and calls in MSFT stock is one way to play this undervalued stock.

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.