Should You Buy This Hot Data Center Stock Before 2025 Ends?

/AI%20(artificial%20intelligence)/AI%20software%20engineering%20by%20Tapati%20Rinchumrus%20via%20Shutterstock.jpg)

Vertiv (VRT) has been one of the standout performers in the data center infrastructure space this year, with momentum that shows no signs of slowing down. Artificial intelligence (AI), cloud computing, and digital transformation are driving enormous demand for next-generation data centers. Vertiv, a key supplier of power, cooling, and infrastructure solutions, is poised to capitalize on this global shift.

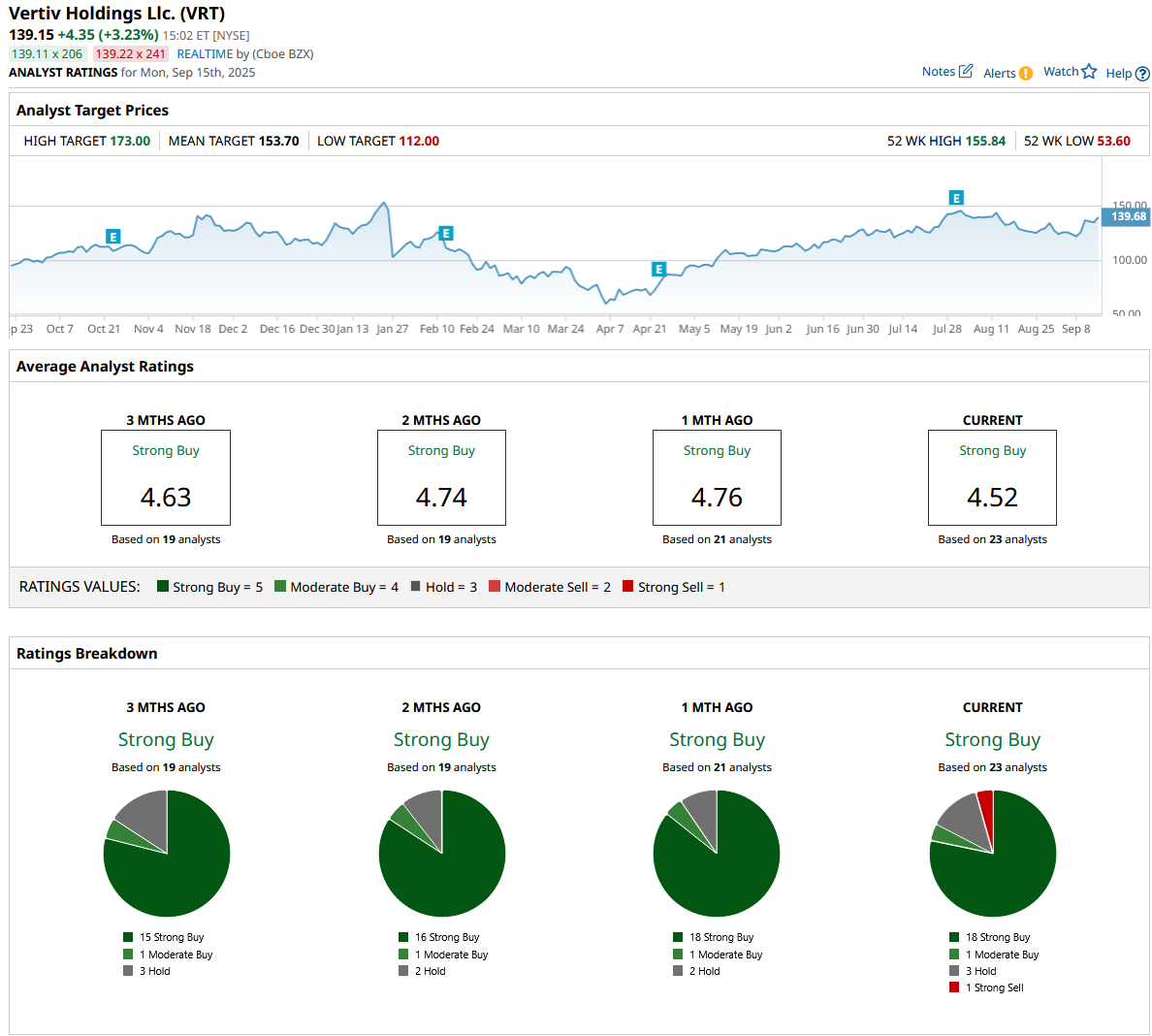

Wall Street is highly optimistic about this data center stock, rating VRT a “Strong Buy.” Let’s find out if Vertiv is a good buy before 2025 comes to an end.

About Vertiv Holdings

Valued at $51.5 billion, Vertiv Holdings is a data center infrastructure company. Its core business is providing the hardware, software, and services that keep data centers, communication networks, and other critical digital infrastructure running reliably. Some of its products include uninterruptible power supplies (UPS), DC power systems, liquid cooling solutions, racks, and containment, among others.

Vertiv Reported Strong Growth in Q2

In the second quarter, Vertiv reported adjusted diluted earnings of $0.95 per share, a robust 42% year-over-year (YoY) increase. The bottom-line growth was fueled by strong revenue momentum. Organic sales increased 34% YoY, driven by demand in almost every market globally. The Americas led the way, with growth in the mid-40% range, while Asia-Pacific grew by the mid-30% range. Europe, the Middle East, and Africa (EMEA) grew at a high single-digit pace, despite tariffs and supply chain realignment issues.

Total orders exceeded $3 billion for the first time in a single quarter. The company's book-to-bill ratio of 1.2 indicates that backlog is still growing, hitting $8.5 billion by quarter-end. Vertiv's balance sheet is still healthy, with $2.5 billion in liquidity and a net leverage ratio of just 0.6x. A low net leverage ratio indicates that Vertiv is in a healthy position where earnings easily cover its debt load. In addition, the company generated $277 million in free cash flow during the quarter.

A key driver of Vertiv’s growth strategy has been targeted acquisitions, aimed at expanding its technological footprint and strengthening its position as the “connective tissue” between IT infrastructure and critical data center operations.

This liquidity gives the company the financial flexibility for further investment and acquisitions, such as its intention to acquire Great Lakes Data Racks & Cabinets, which specializes in high-end racks, cabinets, and cable management solutions, critical components in increasingly dense, AI-driven data center environments. Vertiv believes that this acquisition will strengthen its position in the high-density white space solution market.

Riding the AI and Data Center Boom

Despite strong results, the company has not been immune to external pressures such as tariffs and supply chain issues. The company has been aggressive in reworking its supply chain, ensuring long-term resilience while investing ahead of anticipated demand. Management anticipates that these pressures will largely ease by the end of the year.

Management raised full-year 2025 guidance, citing accelerating demand and operational improvements. Net sales are now estimated to reach approximately $10 billion, indicating a 24% organic increase. Adjusted earnings could rise 33% YoY, to $3.80 per share. Free cash flow could total roughly $1.4 billion. Analysts covering the stock expect Vertiv’s earnings to increase by 34% in 2025, followed by 25.3% in 2026.

Out of the 23 analysts that cover VRT stock, 18 rate it a “Strong Buy,” one says it is a “Moderate Buy,” three rate it a “Hold,” and one says it is a “Strong Sell.” The average target price for VRT stock is $153.70, representing potential upside of 14% from its current levels. The high price estimate of $173 suggests the stock can rally as much as 24.4% this year.

VRT has soared 23% year-to-date (YTD), outpacing the overall market gain. The demand for data centers is increasing, thanks to AI workloads, cloud adoption, and the exponential rise of digital infrastructure. Vertiv's position as a solutions provider in both the gray and white spaces offers it a competitive advantage.

If the company continues its streak of spectacular growth over the next few quarters, the stock is likely to reach the high price target of $173. However, priced at 35 times forward earnings, Vertiv appears to be pricey. Risk-averse investors might want to accumulate shares at around $124.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.