Creating a 74% “Dividend” on CRWV Stock Using Options

/AI%20(artificial%20intelligence)/Businessman%20touching%20the%20brain%20working%20of%20Artificial%20Intelligence%20(AI)%20Automation%20by%20Suttiphong%20Chandaeng%20via%20Shutterstock.jpg)

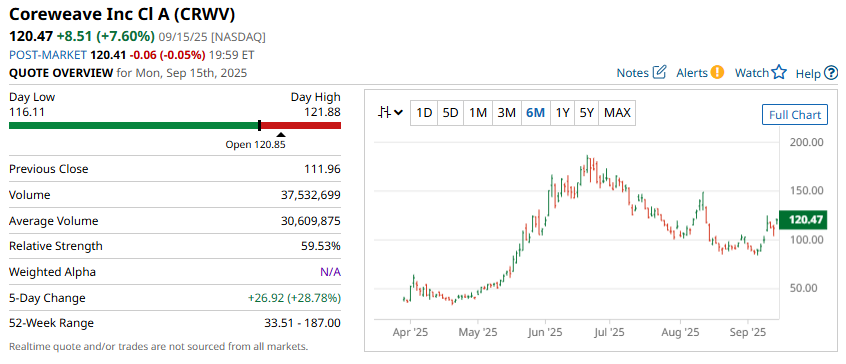

Coreweave (CRWV) stock broke above the 50-day moving average on Monday and is showing positive accumulation on the breakout.

One bad thing about CRWV stock is that it doesn't pay a dividend.

But what if we could use options to manufacture our own dividend?

Does CRWV Pay a Dividend?

Let's say I have $12,000 to invest into CRWV stock, I could simply buy 100 shares and hope the stock rises.

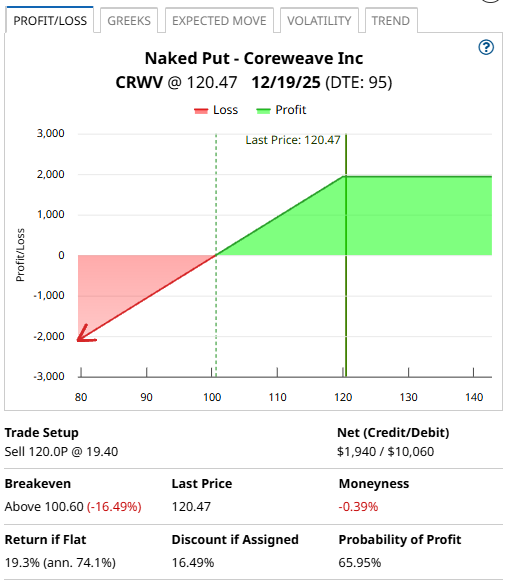

But, if I want a more conservative play, I could sell a December 19, 2025 put with a strike price of $120 and set aside the $12,000 in case I am assigned on the short put.

That $120-strike put generates around $1,940 in option premium in around three months.

So, my $12,000 investment into CRWV is giving me a 74% annualized "dividend".

Risks of the Trade:

Much like owning CRWV shares, if the stock drops, I'm going to lose money in the short-term.

If CRWV is below $120 in December, then I will be forced to buy 100 shares at $120.

The breakeven price is equal to the strike price less the premium received, which in this case would be $100.60.

So if CRWV is below $100.60, at expiration the trade loses money.

But, if CRWV stays above $120 then I achieve a 74% per annum return when the put expires worthless.

Cash secured puts are a bullish strategy but are considered slightly less bullish than owning CRWV stock because the potential gains are limited to the premium received.

The second risk with the trade is that if CRWV stock goes on a huge rally, we miss out on any upside. The most we can make is the $1,940 from the option premium.

Greeks and Equivalent Exposure Level

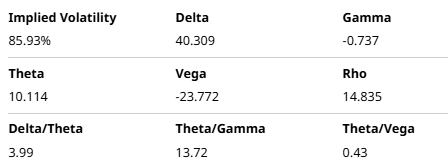

The $120-strike put currently has a delta of 40, so selling this put gives an exposure roughly equivalent to owning 40 shares of CRWV stock, although this will change as the stock moves up and down.

It also means the put has a roughly 60% chance of expiring worthless.

One method which can help cut the risk is to turn the trade into a spread and buy a $100-strike put. This turns the trade into a bull put spread and cuts the risk from $10,060 to around $2,000.

There are lots of interesting scenarios you can create with options.

Company Details

CoreWeave Inc. is a cloud-computing company.

It specializes in providing cloud-based graphics processing unit infrastructure to artificial intelligence developers. CoreWeave Inc. is based in Livingston, New Jersey.

Implied volatility is currently 84.10% compared to a twelve month low of 68.79% and a twelve month high of 172.94%.

Of the 23 analysts covering CRWV, 8 have a Strong Buy rating, 14 have a Hold rating and 1 has a Strong Sell rating.

Please remember that options are risky, and investors can lose 100% of their investment. This article is for education purposes only and not a trade recommendation. Remember to always do your own due diligence and consult your financial advisor before making any investment decisions.

On the date of publication, Gavin McMaster did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.